VIRTUAL CHILDREN’S BANK KIDOBANK.COM

Let’s give children a head start – teach them what many adults still don’t know even today.

KidoBank is a fun and educational app that teaches children aged 5 to 15 how to understand money through play, simple tasks, and their own decisions. They can try saving for their dreams, borrowing from a parent with an agreed interest rate, or investing virtual money in stocks, ETFs, or commodities – all in a safe, ad-free environment that emphasizes sensible decision-making.

Education

Playful learning that shows children how money works in the real world.

Financial Literacy

We build financial literacy from childhood – fun, practical, and easy to understand.

Investing

Children here discover how money can work for them – investing in a playful way.

Saving and Borrowing

💸 Regular pocket money directly to the child’s account in the app

🎯 A virtual savings account with goals (e.g. a toy, a trip)

🧹 Rewards for simple household chores

🔁 The option to repay their own “debts” in the virtual system

🧸 A virtual loan for a toy, trip, or other wishes

📊 The parent sets the interest rate and repayment rules

⚖️ A comparison of the benefits of saving vs. borrowing

🔐 A safe environment – everything is virtual and fun

💡 Understanding terms like interest, debt, installments, and responsible decision-making

Investing and Education

💰 Virtual investing in 20 stocks, ETFs, gold, oil, and cryptocurrencies

🛡️ No real risk – it’s all a safe and simulated environment

👨👩👧👦 The parent has an overview and control over the child’s investments

📚 Teaching children about investing from an early age

📈 Understanding risk, returns, and long-term growth

🎯 Bonuses and rewards for completed finance quizzes

🕒 Encouraging patience and responsibility when handling money

🧠 Laying the foundations of financial literacy in a fun way

🎮 Gamified learning – children are motivated to learn through tasks and rewards

🏆 Personal profile and progress – the child builds their own investment history

YouTube series: Kido explores the world of money

Follow the cheerful squirrel Kido, who navigates a life full of decisions, mistakes, and victories—just like every adult.

From the first pocket money, through borrowing, saving, the first salary, all the way to investments and entrepreneurship. In this playful series, children learn what responsibility means, how money works, and that every decision has consequences.

Kido guides them through the world of finance with humor, simply and clearly—so they learn without even realizing it. A new episode every week!

🧠 Education

Children learn in a playful way how money, decision-making, and responsibility work in everyday life.

💡 Financial literacy

Each episode develops children’s understanding of money – from pocket money to investments, in a simple and practical manner.

📈 Investing

Children see that money can “work” too – they learn the basics of risk-free investing in a fun way.

🧭 Life skills

Watching Kido, children build habits that help them make better financial decisions in real life.

KidoBank App Features

We educate children for life, not just for grades.

KidoBank is an educational application that teaches children from the age of 5 the basics of financial literacy through games, stories, and personal decisions. Thanks to virtual accounts, children can try saving for their dream goals, borrow money with a pre-agreed interest from a parent, or invest in stocks, ETFs, and commodities—all in a safe and controlled environment with no ads.

The application consists of 4 sections: current account, saving, loans, and investing.

Kido the guide – a cheerful and curious squirrel – leads them through the world of money with fun videos, simple explanations, and practical tasks. In the application, children learn not only what money is, but also how to handle it wisely. They discover the value of patience, the difference between needs and wants, and learn that every decision has consequences.

Parents have full control – they can set up accounts, track progress, and create tasks or rewards. KidoBank is the ideal way to give kids a head start in life and teach them something often missing from school curricula – financial responsibility.

🏦 Current account – the first step toward financial independence

The current account in KidoBank teaches children to handle money by making their own decisions. In a safe, playful environment, they develop habits crucial for real life.

💸 Regular pocket money directly to the child’s account in the application

🧹 Rewards for small household chores or completing quizzes

📥 Tracking income – pocket money, rewards, bonuses

📤 Tracking expenses – toys, trips, loan repayments

💡 The parent can set regular expenses, like “virtual rent” – the child learns to plan ahead

🧠 Financial planning without risk – everything is just a simulation

🎮 Gamified learning – rewards, tasks, fun challenges

🧍♂️ Personal profile and progress – motivation by watching their own growth

💰 Saving – goal, patience, and reward

In KidoBank, children try saving for their own goals. The savings account trains patience and clarifies essential financial concepts.

🎯 Virtual saving for specific goals – a toy, trip, or gift

📊 The parent sets the interest – children learn what interest is and how it works

💡 Understanding the benefits of saving versus borrowing

⚖️ Comparing different strategies – save vs. borrow

⏳ Practicing patience and planning – enjoying the moment when the goal is reached

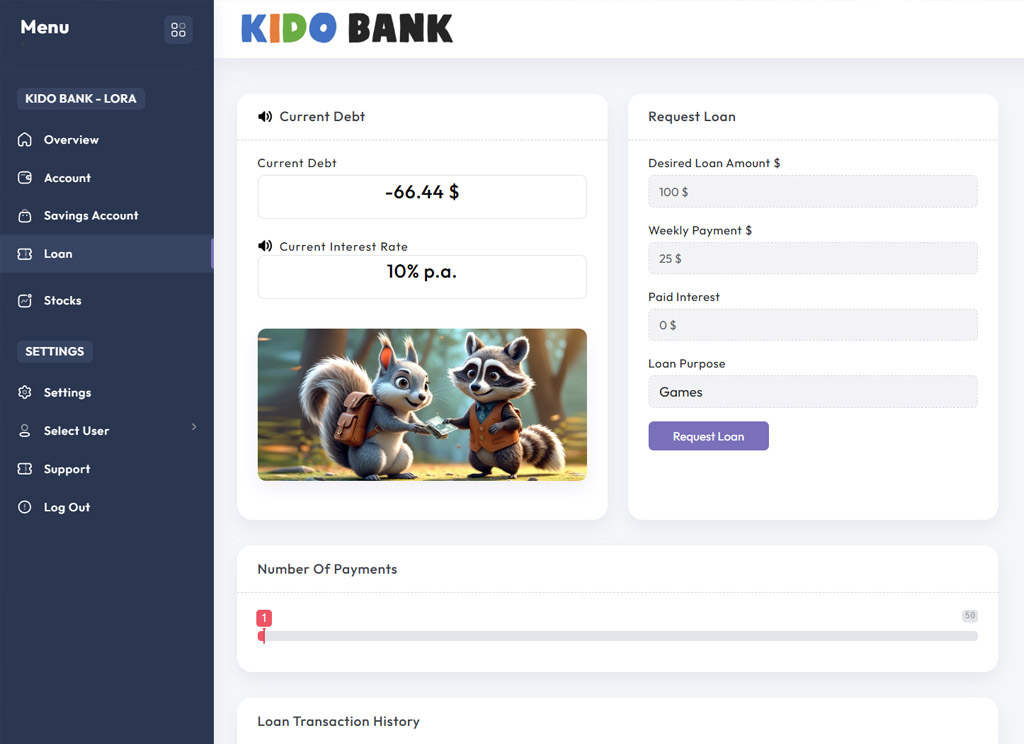

💳 Loan – responsible decision-making in practice

Virtual loans in KidoBank explain interest, debt, installments, and responsibility. The child learns that not every wish needs to be fulfilled immediately.

🧸 The option to borrow for dreams – a trip, a toy, an experience

📊 The parent sets the interest and repayment conditions

🔁 The child repays their “debts” through a virtual system

💡 A clear explanation of terms – debt, interest, principal, installments

🎯 Learning by making decisions – what’s worth it and what isn’t

📈 Investments – a children’s simulator of real markets

A simulation of a virtual investment account that introduces children, in a fun way, to the world of stocks, ETFs, and commodities. Children get a head start from an early age.

They soon understand that investing can yield higher returns than saving, but that the market does not only go up – declines are a natural part of it.

We believe this part of the app offers the greatest benefit to children’s futures. Children who understand investing will have a significant advantage over their peers when they finish school.

💰 Virtual investing in 20 stocks, ETFs, commodities, and cryptocurrencies

🛡️ Completely without real risk – everything is a simulation

📚 Education on markets and investment tools

📈 Understanding returns, risks, downturns, and growth

🕒 Long-term thinking – investments need time

👨👩👧👦 The parent has an overview and control – sets limits and monitors progress

🎯 Bonuses for successful finance quizzes

🧠 The basics of financial literacy in a fun format

🎮 Motivating tasks and rewards – learning becomes a game

🏆 The child builds their own investment history – track the progress

FAQ – Frequently Asked Questions

🧾 1. Is the KidoBank service really free?

Yes, at the moment the entire service is free. In the future, we may charge for some advanced or premium features, but the basic educational tools will remain free for everyone.

💳 2. Do I have to send real money to the child’s account?

No. KidoBank only uses virtual money. Parents manage the “bank” for their children and any real transactions (e.g., cash, an actual bank transfer) happen outside the app. All moves in the app are only simulations.

👀 3. Does the child have access to real money or cards?

No. Children do not have access to real money, bank accounts, or cards. Everything is done exclusively in a virtual, safe environment for financial management, investing, and learning—not for real payments.

👨👩👧 4. Do I, as a parent, have control over what my child does?

Yes. The parent has full visibility and control of the child’s accounts. You can set goals, add money, create tasks, approve transactions, and track progress. The child is learning, but you hold the reins.

🔒 5. Is using the app secure and private?

Absolutely. We do not collect sensitive data about children – the parent’s email is enough to register. We don’t show ads, don’t sell data to third parties, and the entire service is designed with privacy and children’s protection in mind.

🧒 6. From what age is the app suitable?

KidoBank is designed for children from 5 years old, but with simple language, a playful approach, and guidance from Kido, even younger ones can manage it with the help of a parent. Older children (8–12) can handle many features on their own.

🧒 7. Who is behind KidoBank.com and why?

We are parents who wanted a fun, simple, and safe way to teach our children about money—how to save, invest, and understand why not everything can be bought right away. When we couldn’t find such an app, we decided to create it ourselves. KidoBank is a project by parents for parents (and their children), combining fun, responsibility, and financial education. We are not a big corporation or a marketing team in suits—just people who don’t want our kids growing up clueless about finances.